0%

Around 30% of online shoppers mention complex checkout processes or security concerns as reasons for cart abandonment, which means that choosing the right payment gateway is key.

E-commerce businesses often struggle to select an appropriate payment gateway and focus too narrowly on cost or ignore compatibility issues. Such missteps can lead to lost sales and erode customer trust.

In this article, we’ll take a look at how to select the best payment gateway and highlight key factors such as cost-effectiveness, compatibility, and security.

What are Payment Gateways?

Payment gateways are services that authorize and processpayments for online purchases. They act as intermediaries between stores and customers, ensuring the secure transfer of transaction data.

In an e-commerce context, payment gateways facilitate the acceptance of payments from customers, which allows you to sell your products or services online. They are responsible for the secure transmissionof card information from the customer to your store’s account.

Here are the key benefits of payment gateways:

- Secure Transactions – Encrypt payment data and comply with PCI-DSS standards to protect customer information.

- Fraud Prevention – Use advanced security measures to detect and block suspicious transactions.

- Seamless Integration – Connect easily with e-commerce platforms and shopping carts.

- Multiple Payment Methods – Support credit and debit cards, digital wallets, and alternative payment options.

- Real-time Processing – Instantly verify and authorize payments, reducing checkout delays.

- Reporting & Insights – Provide transaction data and analytics to track sales trends.

How Do Payment Gateways Work

To understand the role of payment gateways in online shopping, let’s break down their core functions.

Authorization

When a customer initiates a payment, the gateway verifies their payment method with the issuing bank or financial institution. This step confirms the availability of funds and the legitimacy of the customer payment, reducing the risk of fraud or declined payments.

Encryption

Payment gateways encrypt sensitive information like credit card numbers to protect customer data during transmission. This encryption protects against data breaches and identity theft, which maintains customer confidence in online shopping.

Order Processing

Once authorized, the transaction is processed, and the payment gateway communicates the result (approval or decline) to both the merchant and the customer. This ensures seamless order fulfillment and instant transaction updates.

Settlement

Approved transactions proceed to settlement, where funds are transferred from the customer’s bank to the merchant’s account. Settlement times vary from instant to several days, depending on the payment method and financial institutions involved.

Timely settlement is important as it manages cash flow and ensures that your store can continue operations without financial bottlenecks.

Fraud Detection

Throughout the process, payment gateways employ fraud prevention tools such as Address Verification Systems (AVS), CVV verification, and transaction monitoring. These safeguards detect suspicious activity and protect both merchants and customers from unauthorized transactions.

These measures protect your store from financial losses and safeguard customers from unauthorized transactions, reinforcing the overall security of the e-commerce ecosystem.

Impact on User's Purchase Experience

A well-integrated payment gateway enhances the customer journey, making transactions smoother, safer, and more convenient.

- Faster Checkout: An efficient payment gateway ensures a quick and smooth checkout process, reducing the risk of cart abandonment.

- Enhanced Security and Trust: Familiar and secure gateways like PayPal or Stripe increase customer trust, encouraging them to complete a purchase.

- Flexible Payment Options: Support for credit cards, digital wallets, and alternative payment systems ensures customers can pay using their preferred method.

- International Payments: Handling multiple currencies and cross-border payments lets international shoppers buy without complications.

- Instant Confirmation: Immediate transaction confirmations assure customers of successful order processing, boosting their confidence and trust in the merchant.

Get in touch

with our expert

Discuss your project requirements and get a free estimate.

Get in touch

with our expert

Discuss your project requirements and get a free estimate.

5 Key Factors for Choosing a Payment Processor

When you consider how to choose a payment processor, several factors should influence your decision:

1. Security

Security is key. Ensure that the payment gateway you choose complies with the Payment Card Industry Data Security Standard (PCI DSS). This compliance protects sensitive customer data and prevents fraud, which means it is very important.

2. Cost Structure

Understand the various fees associated with payment gateways, such as setup fees, transaction fees, and currency conversion rates. Some gateways charge per transaction, while others might have monthly fees. Be sure to choose a cost structure that aligns with your business volume and model.

3. Compatibility

Your payment gateway should seamlessly integrate with your e-commerce platform, whether it’s Magento, Shopify, WooCommerce, or another option. This compatibility ensures smooth operation and minimizes the risk of disruptions.

4. Scalability

As your business grows, your payment gateway processor should be able to handle increased transaction volumes and support expanding business needs. This way you can maintain efficient operations without interruptions or delays in payment processing.

5. Customer Support

Reliable and responsive customer support is key for addressing any issues or questions promptly. A payment gateway with strong customer support can quickly resolve technical problems and assist in your system optimization process.

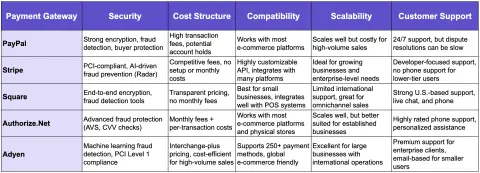

Popular Payment Gateway Options: Comparison Table

To help you make an informed decision, let's evaluate some popular types of payment gateway methods: PayPal, Stripe, Square, Authorize.Net, and Adyen.

Key Takeaways for Decision-Making

- Security – All gateways offer strong protection, but Authorize.Net and Adyen provide the most advanced fraud detection tools.

- Cost Structure – Square and Stripe have simple, transparent pricing, while Adyen is more cost-effective for high-volume merchants.

- Compatibility – Stripe and Adyen excel in customization and platform integrations. PayPal and Authorize.Net work well across standard platforms.

- Scalability – Adyen and Stripe are best for businesses with high transaction volumes or international expansion needs.

- Customer Support:Authorize.Net and Square provide strong, hands-on support, while Stripe is more suited for developers with self-service resources.

Advanced Features to Look For in Payment Methods

Payment gateways rapidly advance with new features and technologies, which enhance functionality and user experience. You should keep up with trends like cryptocurrency support and one-click checkout to optimize your sales process and broaden your customer base. Let's take a closer look:

Cryptocurrency Support

With the rise of digital currencies, more payment gateways are supporting cryptocurrency. This enables store owners to cater to a broader audience that prefers or requires transacting in cryptocurrencies like Bitcoin and Ethereum, which provides them with a modern, flexible payment option.

One-Click Checkout

One-click checkout simplifies the payment process and allows returning customers to use stored payment and shipping information to make purchases with a single click. This feature significantly reduces friction during the checkout process, which increases conversion rates and improves user satisfaction.

AI and Machine Learning in Payment Solutions

Artificial intelligence (AI) and machine learning (ML) algorithms now have a key role in payment solutions, as they enhance security and personalize user experiences. They analyze transaction patterns in real time to quickly detect and prevent fraudulent activities, which reduces fraud, minimizes chargebacks, and safeguards sensitive consumer data.

At the same time, AI and ML analyze user behavior, preferences, and transaction history to offer tailored recommendations and insights. This approach enhances user satisfaction and fosters loyalty through a more seamless and intuitive shopping experience.

Takeaways: Which Payment Gateway Is Better for Your Store?

To select the right payment gateway tailored to your business needs, learn how payment gateways work and review popular options to find the best fit for your store. A well-chosen gateway can reduce payment processing times and improve the user experience, ultimately leading to higher customer satisfaction and increased sales.

Navigating the selection and setup of a payment gateway may sound complicated, but we're here to assist you. Contact Transform Agency expert team today to streamline gateway integration into your store.

FAQ

How to choose a payment gateway?

When choosing a payment gateway, consider factors like transaction fees, security features, ease of integration, supported payment methods, and customer support to find the best fit for your business needs.

What key features should a payment gateway have?

Look for features like multi-currency support, mobile payment compatibility, strong security measures, and easy integration to ensure a seamless customer experience.

Why is customer support important for payment gateways?

Reliable support helps quickly resolve issues, minimizing disruptions to your business and maintaining customer satisfaction.

Is geographical coverage of a payment gateway important?

Yes, ensure the gateway supports transactions in your customers' regions and offers common payment methods to broaden your customer base.

How do transaction fees affect payment gateway choice?

Transaction fees impact profit margins, so compare costs like setup fees and per-transaction charges to select a cost-effective option for your business.

Written with the assistance of Sergey Girlya

Adobe Commerce Business Practitioner | Certified PSM & PSPO at TA

Sergey ensures project success by validating business cases, defining success metrics, and identifying sustainable benefits. His proactive approach leverages existing systems, processes, and data to deliver additional value. Serge excels in planning, executing, monitoring, and controlling all aspects of the project lifecycle, ensuring meticulous attention to detail and strategic oversight.

Sergey ensures project success by validating business cases, defining success metrics, and identifying sustainable benefits. His proactive approach leverages existing systems, processes, and data to deliver additional value. Serge excels in planning, executing, monitoring, and controlling all aspects of the project lifecycle, ensuring meticulous attention to detail and strategic oversight.